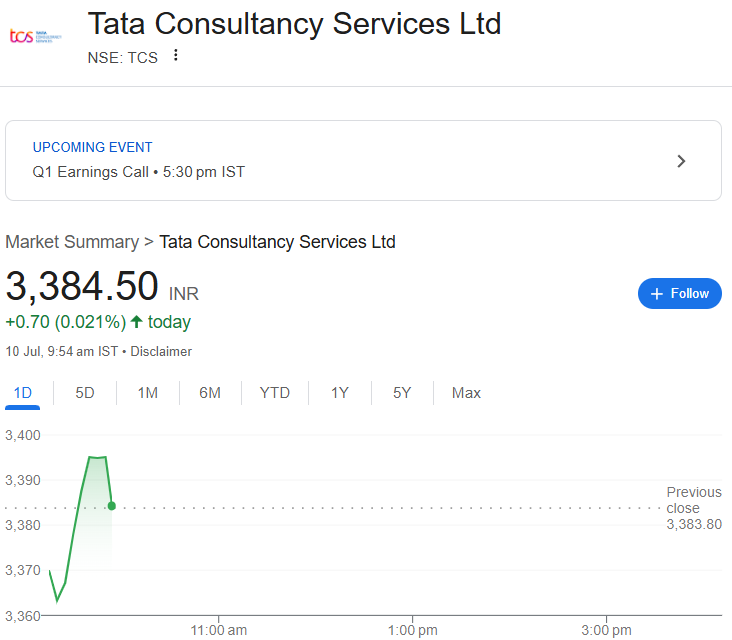

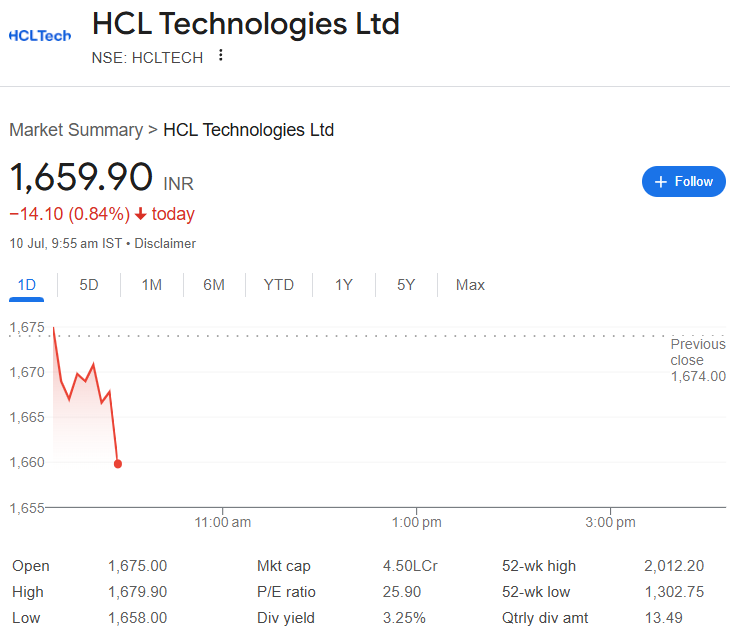

📈 Top Stocks in Focus Today: TCS, Bharti Airtel, HCL Tech & IREDA Lead Market Action

July 10, 2025 - Indian markets took a breather on Wednesday as investors turned cautious ahead of earnings season. The Sensex dipped 0.21% to 83,536.08, while the Nifty50 slipped 0.18% to 25,476.10. Here's what's moving markets today:

🔥 10 Key Stocks Driving Today's Market

1. TCS & IREDA Earnings in Spotlight 🏦

Today's big ticket earnings include:

- TCS - All eyes on IT demand and margin outlook

- IREDA - Green energy financing growth in focus

- Tata Elxsi - Design tech services expectations high

Pro Tip: Watch for management commentary on future guidance.

2. Dividend Plays 💰

These stocks go ex-dividend today:

- Dr Reddy's Labs - Pharma major's payout

- Wheels India - Auto component player

- LMW - Textile machinery dividend

3. Block Deal Alert! 🚨

Embassy REIT sees ₹681 crore stake sale (1.9%) by APAC Company - could increase volatility.

4. Indosolar OFS Opens 📢

Promoter selling 10 lakh shares (2.4% stake) at ₹265/sh floor price:

- July 10: Institutional bidding

- July 11: Retail investors get chance

5. HCL Tech's Smart Vehicle Push 🚗

New partnership with Astemo Cypremos to boost autonomous vehicle tech - long-term growth play.

6. Airtel Money Goes Live 💳

Telecom giant launches wholly-owned fintech subsidiary to expand in digital payments and lending.

7. RailTel's ₹17.5 Crore Win 🏆

New order from Chhattisgarh govt for network infrastructure - positive for government business pipeline.

8. Ambuja Cements Expands 🏗️

New 1.5 MTPA grinding unit operational in Jharkhand - total capacity now 104.45 MTPA.

9. Emcure Pharma's USFDA Win ✅

Zero observations at Ahmedabad oncology plant - regulatory clearance boosts export prospects.

10. Quick Bites 🍔

- NCL Industries: Cement output down 4-5% YoY

- Blue Dart: 50% off Rakhi shipments

- Enviro Infra: ₹395.5cr Maharashtra order

📊 Today's Market Outlook

The TCS results will set the tone for IT sector. Watch these key levels:

- Nifty Support: 25,400

- Nifty Resistance: 25,600

⚡ High-Volatility Watchlist

- TCS - Post-earnings reaction

- IREDA - Renewable energy sentiment

- Indosolar - OFS impact

- Emcure - USFDA boost

💡 Conclusion:

Today's market moves will hinge on three key factors:

- Corporate earnings quality and guidance

- Global trade policy developments

- Institutional flows pattern

"The TCS numbers will be the canary in the coal mine for IT sector performance this quarter," says market analyst Rohan Mehta.

What's your take? Are you bullish on IT or betting on domestic cyclicals? Let's discuss in the comments! 👇

Launch your Graphy

Launch your Graphy