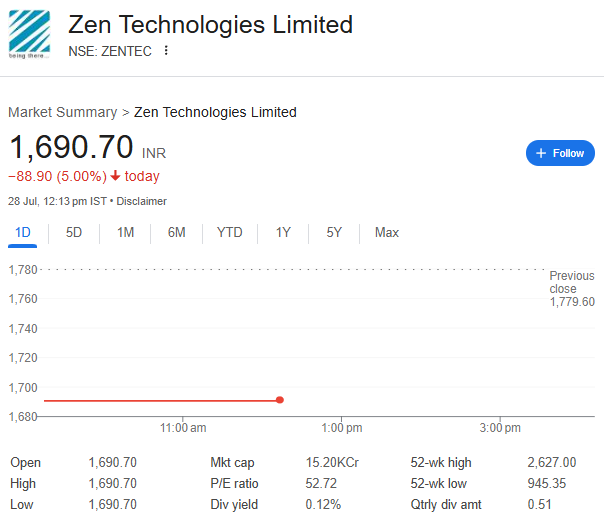

The Indian defense sector's rising star Zen Technologies faced brutal market punishment on Monday as its Q1 FY26 report card revealed alarming red flags. Investors hit the panic button, sending shares straight into the 5% lower circuit at opening bell.

📉 The Ugly Numbers Behind the Crash

Here's why traders are running for the exits:

- Net profit nosedived 38% YoY to ₹47.75 crore (from ₹76.81 crore)

- Revenue collapsed 37.9% to ₹158.22 crore

- EBITDA got crushed by 42% to ₹64.70 crore

- Margins squeezed to 40.9% (down 208 basis points)

📊 From Market Darling to Pariah?

Don't let the bloodbath fool you - this multibagger has made fortunes:

- 🚀 889% returns in 3 years

- 📈 169% gain since 2023

But technicals scream danger now:

- 📉 Trading below all key moving averages

- ⚖️ RSI at 35.9 (neutral but bearish)

- 🎢 High volatility (Beta: 1.1)

🧠 Smart Investor Takeaway

Q1 results are like a corporate health checkup. For Zen Tech, the vital signs look concerning:

| Metric | What It Reveals |

|---|---|

| Net Profit | The bottom line - actual earnings after all costs |

| EBITDA | Core operational profitability |

| Revenue | Top-line business growth |

| Margins | How efficiently profits are squeezed from sales |

🔮 CONCLUSION:

While the long-term story remains intact given India's defense spending boom, short-term investors got a brutal reminder: even multibaggers need breathing room. The coming weeks will reveal whether this is a temporary stumble or the start of deeper correction.

Launch your Graphy

Launch your Graphy