As we gear up for an exciting trading week ahead, investors have a golden opportunity to track some lucrative dividend payouts and bonus share announcements. Major players like TCS, Bharti Airtel, and Kotak Mahindra Bank are going ex-dividend, while Ashok Leyland and Motherson International are offering bonus shares!

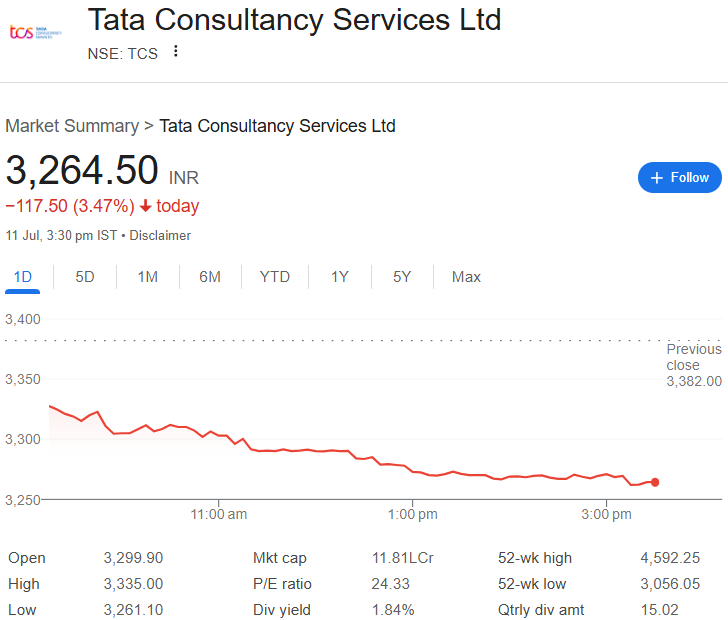

💼 TCS Interim Dividend FY25: Don't Miss Out!

India's IT crown jewel Tata Consultancy Services has declared an interim dividend of ₹11 per share for FY25. Mark your calendars for the record date of July 16 - shareholders registered by this date will qualify for the payout. According to exchange filings, these dividends should hit your accounts by August 4 (subject to approval).

📶 Bharti Airtel's Final Dividend: Telecom Investors Rejoice!

Telecom giant Bharti Airtel has proposed a final dividend of ₹16 per share (on face value of ₹5) for FY24. The crucial record date is July 18, with payouts scheduled within 30 days after AGM approval. This is fantastic news for long-term investors in this telecom powerhouse!

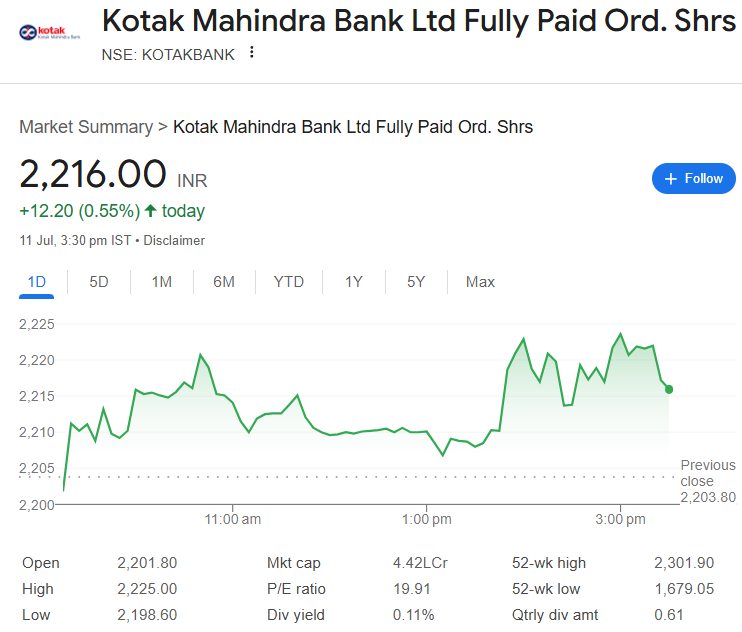

🏛️ More Dividend Stars: Banking & FMCG Sectors Shine

Here's a quick checklist of other major players turning ex-dividend next week:

- Kotak Mahindra Bank – ₹2.50/share | 📅 Record Date: July 18

- IDBI Bank – ₹2.10/share | 📅 Record Date: July 15

- Cummins India – ₹33.50/share | 📅 Record Date: July 18

- Mahindra Finance – ₹6.50/share | 📅 Record Date: July 15

- Dabur India – ₹5.25/share | 📅 Record Date: July 18

🎁 Bonus Share Bonanza: Free Stocks Coming Your Way!

It's not just about dividends - these companies are rewarding shareholders with bonus shares:

- Samvardhana Motherson International Ltd

- Ashok Leyland Ltd

- Motherson Sumi Wiring India Ltd

The ex-bonus status means eligible investors will receive additional shares proportional to their current holdings - like getting free stock!

🔍 Smart Investor's Playbook: Key Considerations

The coming week presents a strategic window for both dividend hunters and bonus share enthusiasts. With quarterly earnings season in full swing and global market developments, we could see some interesting price movements around these corporate actions.

💡 Conclusion: Your Action Plan

Whether you're building a passive income stream through dividends or looking to grow your shareholding via bonus issues, the next few days are absolutely crucial. Here's what you should do:

- 📅 Mark all record dates in your trading calendar

- 💼 Review your portfolio holdings for eligibility

- 📊 Analyze company fundamentals beyond just the corporate actions

- ⏳ Time your investments strategically around these dates

At MBC Trading Platform, we're committed to helping you make informed investment decisions. Whether through our real-time market updates, offline/online trading classes, or expert analysis, we've got your back in the exciting world of stock market investing!

Happy investing! May your portfolio grow as steadily as your knowledge 📈✨

Launch your Graphy

Launch your Graphy