There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Wed May 21, 2025

As the Q4 results season kicks in, several key players including railway PSUs, oil sector majors, and FMCG giants are witnessing a mixed performance in the stock market. Investors are closely tracking movements in RVNL, IndusInd Bank, NTPC Green Energy, IRCON International, ITC, ONGC, Oil India, and PFC ahead of their quarterly earnings reports. 🏦📊

Among the railway public sector undertakings, IRCON International surged by 1.54%, trading at ₹191.20, while Rail Vikas Nigam Ltd (RVNL) saw a modest 0.4% uptick to ₹416.70. These slight gains reflect investor optimism as earnings expectations remain steady. 💹

NTPC Green Energy Ltd, another notable PSU, held firm at ₹103, signaling stability in the renewable energy segment. Meanwhile, Power Finance Corporation (PFC) rose 0.84% to ₹410, continuing its consistent upward trend. 📈

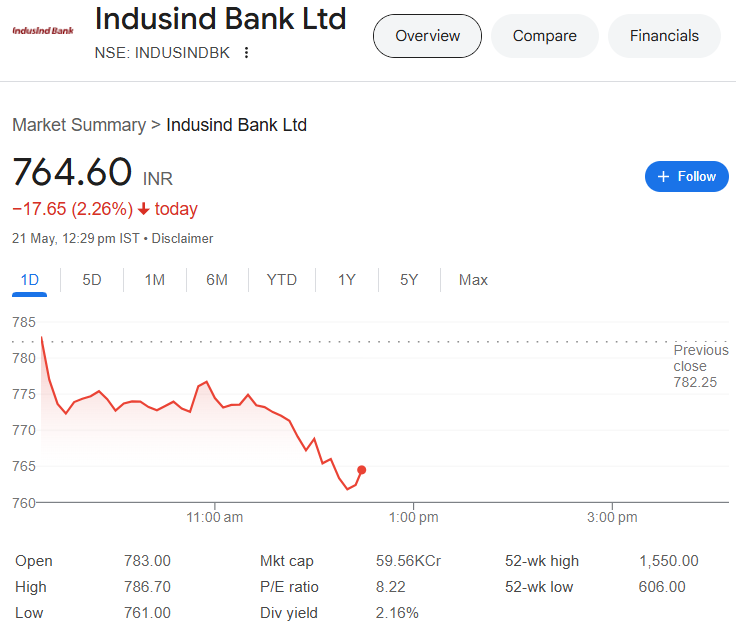

IndusInd Bank's stock dropped 1.22% to ₹772.45 following news of a potential ₹1,960 crore discrepancy in its derivatives portfolio and an additional ₹674 crore issue in its microfinance portfolio (MFI). These irregularities, combined with the exit of key executives like the MD & CEO and CFO, have raised serious questions around corporate governance and internal controls. 🚨

According to ICICI Securities, these developments reflect "lapses in governance" that could have deeper implications as the bank announces its Q4 financials.

ITC Ltd traded 0.43% higher at ₹436.70 on the BSE. The FMCG major is expected to post up to 9% year-on-year (YoY) growth in net sales. However, net profit may witness a flat to 8% YoY decline, largely attributed to the Hotels division demerger and its financial impact. The company is also expected to consider a final dividend for FY2024-25, which could offer additional value to investors. 💰

Oil PSUs such as Oil and Natural Gas Corporation (ONGC) and Oil India Ltd showed positive movement. ONGC edged up by 0.32% to ₹250, while Oil India climbed 1.08% to ₹427.60. ⛽

According to Emkay Global, ONGC's Ebitda is likely to drop 3% quarter-on-quarter (QoQ) due to rising operational costs and statutory levies, partially offset by lower dry well write-offs. In contrast, Oil India's Ebitda could rise 7% on the back of strong oil sales. The removal of windfall tax is expected to boost market-linked oil realizations for Q4FY25, improving overall profitability. 📉➡️📈

With Q4 earnings just around the corner, market participants remain cautious. Stocks like RVNL, IndusInd Bank, ITC, ONGC, and IRCON are reacting in real-time to both internal developments and external expectations. For savvy investors and traders, this period offers both risk and opportunity. 🎢

What's your take? Are you bullish on any of these stocks ahead of their results? Share your thoughts in the comments below! 👇💬

⚠️ Disclaimer: This article is for informational purposes only and should not be considered as investment advice. 📈 Always consult a trusted advisor from MBC Trading Platform before making any investment decisions.

👥 Team MBC

📍 Expert Stock Market Analysts & Trainers serving Rajamahendravaram, Visakhapatnam, and Vijayawada.

💼 Excellence in Market Insights & Training Solutions.

MBC Trading Platform

Monday – Saturday: 9 AM – 7 PM

🏢 Royal Enfield showroom, 26-16-5,

Nandamgani Raju Junction, near Anand Regency, Kambala Cheruvu,

Rajamahendravaram, Andhra Pradesh 533101, India

Read our previous blogs:

Stay updated with the latest stock market insights, news, and updates only on MBC Trading Platform – your trusted destination for stock market offline and online classes!