Tata Steel's latest quarterly update reveals a fascinating mix of short-term challenges and long-term strategic wins. While the stock saw a minor 0.28% dip to ₹161.95 on BSE, the underlying story is more nuanced. Let's unpack what really matters for investors and industry watchers.

⚙️ Production & Deliveries: Temporary Speed Bump Ahead

Crude Steel Output (India): 5.26 million tonnes (a slight 3.8% dip YoY)

Deliveries (India): 4.75 million tonnes (impacted by maintenance)

🔍 Why this matters: The dip comes mainly from planned maintenance at Jamshedpur and NINL facilities. But here's the good news:

- ✅ NINL operations are back online

- ✅ Jamshedpur's G Blast Furnace upgrade completes by July 2025

🚗 Automotive & Special Products: Where Premium Growth Lives

This segment delivered 0.77 million tonnes with 4% YoY growth in high-value products. The new Kalinganagar facility's approval for ultra-high-strength steel grades positions Tata Steel perfectly for future automotive demands.

🏭 Industrial Products: The Silent Performer (+66%!)

With 1.6 million tonnes delivered, this segment shines through:

- 📈 Engineering solutions growing at 5% YoY

- 💡 SmartF@B solutions seeing 66% volume surge

This shows Tata Steel is winning in smart manufacturing solutions.

🛒 E-Commerce: The Digital Steel Revolution

Tata Steel's digital platforms (DigECA + Aashiyana) achieved a whopping 39% GMV growth to ₹1,350 crore. In an old-school industry, this digital traction is seriously impressive.

🌊 Innovation Spotlight: Coastal-Grade Steel

The launch of India's first corrosion-resistant air-cooled bars for coastal regions shows Tata Steel's focus on niche market needs - a smart diversification play.

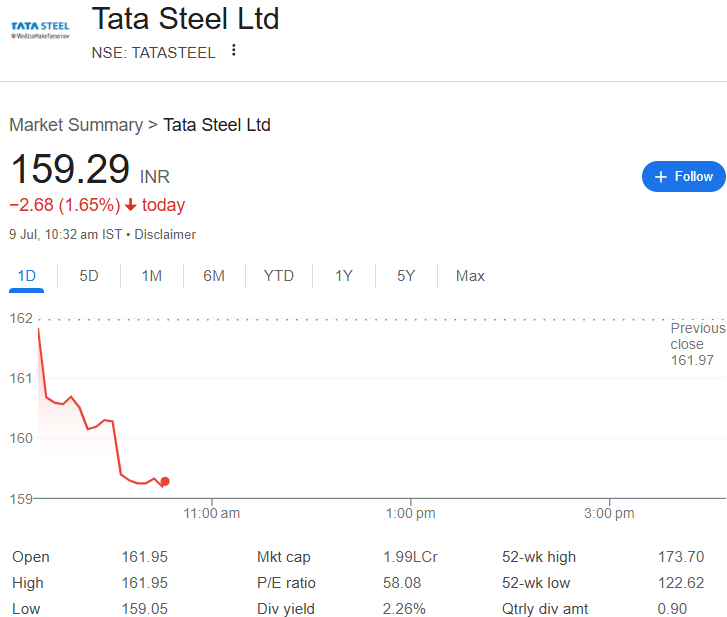

📊 Quick Market Snapshot

- 📉 Market cap: ₹2.02 lakh crore

- 💹 Volume: 10.20 lakh shares traded (₹16.52 crore turnover)

💡 Conclusion: What Investors Should Watch

While maintenance impacted short-term numbers, Tata Steel is strategically positioning itself across multiple growth vectors:

🔮 3 Key Future Indicators:

- Jamshedpur furnace completion (July 2025) - will boost production capacity

- High-end product demand - especially in automotive and construction

- Digital commerce growth - can it sustain this 39% momentum?

🤔 Our Take: This isn't just another quarterly report. It shows a traditional manufacturer successfully navigating short-term challenges while betting big on future-ready segments like digital platforms, premium products, and smart solutions. The coming quarters will reveal if these strategic bets pay off.

What's your view on Tata Steel's positioning? Share your thoughts in the comments! 👇 #TataSteel #Investing #SteelIndustry

Launch your Graphy

Launch your Graphy