There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Tue Dec 16, 2025

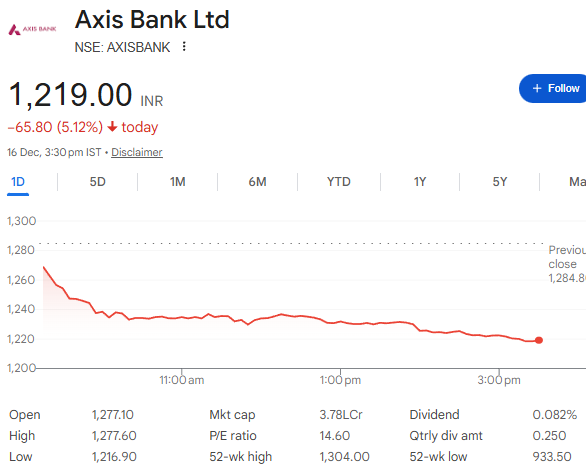

ప్రైవేట్ బ్యాంకింగ్ సెక్టార్లో మళ్లీ uncertainty మొదలైంది 😟. ఈ రోజు Axis Bank share price దాదాపు 4% crash కావడంతో, Nifty Bank index కూడా clear గా pressure లోకి వెళ్లింది. దీనికి ప్రధాన కారణం – Citi Research ఇచ్చిన Net Interest Margin (NIM) pressure warning.

Axis Bank management recent గా Citi Research తో జరిగిన interaction లో NIM recovery timeline delay అయ్యిందని openly share చేసింది. Earlier గా market Q3 FY26 నుంచే margins improve అవుతాయని expect చేసింది. But now, ground reality కొంచెం different.

ఈ update market sentiment ని ఒక్కసారిగా shake చేసింది ⚡. Result గా Axis Bank share price intraday లో ₹1,231 వరకు fall అయ్యింది. Citi still ‘Neutral’ rating maintain చేస్తూ ₹1,285 target price ఇచ్చినా, short-term confidence మాత్రం weaken అయింది.

NIM pressure అంటే simple terms లో చెప్పాలంటే 👇

Interest earned on loans – interest paid on deposits మధ్య gap.

Current market environment లో private banks face చేస్తున్న major challenges:

ఈ combination వల్ల cost of funds increase అవుతోంది, కాని lending yields immediate గా improve అవ్వడం లేదు. ఇది Axis Bank, HDFC Bank, ICICI Bank, Kotak Mahindra Bank లాంటి major private banks అందరికీ common issue.

All banks same level lo suffer అవ్వడం లేదు. High-cost deposits మీద depend అయ్యే private banks maximum pressure lo ఉన్నాయి.

Meanwhile 👉 PSU banks enjoy clear advantage ✅

ఈ contrast recent share price movement లో clearly visible.

Currently Nifty Bank critical 59,000 support zone దగ్గర trade అవుతోంది. Near-term volatility continue అయ్యే chances ఉన్నాయి due to 👇

At the same time, some positive signals also exist 👍

Axis Bank share price fall panic situation కాదు 🚫, but it clearly reminds investors that margin recovery is a slow process.

Long-term investors focus చేయాల్సిన key points 👇

Conclusion:

ఈ NIM pressure phase private banking sector కి ఒక real testing period.

Strong fundamentals ఉన్న banks survive అవుతాయి,

కాని investors realistic expectations maintain చేయడం చాలా important.

⚠️ Disclaimer: ఈ ఆర్టికల్ పూర్తిగా Informational Purpose కోసం మాత్రమే. ఇది ఎలాంటి investment advice కాదు. 📉

స్టాక్ మార్కెట్లో పెట్టుబడి పెట్టే ముందు తప్పనిసరిగా ఒక trusted financial advisor లేదా MBC Trading Platform టీమ్ను సంప్రదించండి. 📈

మీ investment decisions Your Own risk tolerance మరియు financial planning ఆధారంగా తీసుకోవాలి.

👥 Team MBC

📍 Expert Stock Market Analysts & Trainers serving Rajamahendravaram, Visakhapatnam, and Vijayawada.

💼 Excellence in Market Insights & Training Solutions.

MBC Trading Platform

Monday – Saturday: 9 AM – 7 PM

🏢 Royal Enfield showroom, 26-16-5,

Nandamgani Raju Junction, near Anand Regency, Kambala Cheruvu,

Rajamahendravaram, Andhra Pradesh 533101, India

Read our previous blog: HDFC Life Reports 16% Rise in Profit and Strong Premium Growth in Q4 FY25

Stay updated with the latest stock market insights, news, and updates only on MBC Trading Platform – your trusted destination for stock market offline and online classes!